Analysis published last week by Barclays Research—the investment research arm of the multinational bank—suggests that U.S. tobacco giant Altria Group will fall short of its fiscal year 2024 earnings estimates unless falling cigarette sales can be revived with a crackdown on disposable vapes.

Barclays forecasts Altria’s fiscal year 2024 cigarette shipping volumes to decline by 10 percent, and models a 2 percent decline in EBIT (earnings before interest and taxes, a common measure of profitability).

“It is possible,” says Barclays, “that US cig vols improve if the FDA/DOJ are able to successfully clamp down on disposable e-cig growth. If this happens, US cig vols will improve and Altria would be able to meet its [earnings per share] guidance of $5.00-$5.15.”

The FDA hasn’t authorized the sale of any modern disposable vapes, which have gained popularity in recent years, and compete directly with cigarettes in convenience stores and gas stations.

Altria supports PMTA registry laws to boost cigarette sales

Barclays’ insights explain Altria’s support for state bills that would create so-called PMTA registries (or directories), and ban the sale of vaping products that have not been either authorized by the FDA or have premarket tobacco applications (PMTAs) still under review by the agency. Some of the bills also allow the sale of products that have been denied by the FDA, but remain on the market due to federal court orders (like R.J. Reynolds’ Vuse menthol refills).

More than two dozen PMTA registry bills have been introduced in state legislatures since January. The Consumer Advocates for Smoke-free Alternatives Association (CASAA) has issued calls to action for 21 registry bills, indicating they are gaining traction among lawmakers or hearings have been scheduled. New bills are being introduced almost daily.

According to Gregory Conley, legislative and external affairs director for the American Vapor Manufacturers Association (AVM), Altria executives have spoken in favor of registry bills at legislative hearings in multiple states.

The bills are designed to tamp down on sales of popular disposable vapes and bottled e-liquid, both of which compete with Altria’s combustible cigarettes, including the Marlboro brand. Disposable vapes also compete with Altria’s NJOY e-cigarettes, but NJOY is a tiny player in the vape market (and in Altria’s earnings outlook). (Vuse manufacturer R.J. Reynolds—which also produces Newport and Camel cigarettes—also supports PMTA registry laws.)

Alabama, Louisiana and Oklahoma have already passed registry laws, and currently maintain registries of products allowed for sale. Lawmakers in both Alabama and Oklahoma have introduced bills this year that would beef up enforcement of the laws.

Both Altria and R.J. Reynolds have also taken legal action to kill their vape competition. Last October, Altria subsidiary NJOY filed a lawsuit in a federal district court against dozens of manufacturers, distributors and retailers of disposable vapes, including the Breeze, Elf Bar, Esco Bar, Flum, Juice Box, Lava Plus, Loon, Lost Mary, Mr. Fog and Puff Bar brands. NJOY asked the court to bar imports by the companies, and said it would “consider further litigation activity.” (In January, the court dismissed most of the lawsuit.)

The FDA does its part to protect cigarettes

The FDA Center for Tobacco Products (CTP) has engaged for years in a whack-a-mole war with independent vaping businesses, mostly manufacturers and sellers of e-liquid and disposable vapes.

The agency has issued hundreds of warning letters, ordering manufacturers and retailers to remove products from the U.S. market, and has followed up to seek high-dollar “civil money penalties” (fines) from repeat offenders. In some instances, the FDA has enlisted help from the Department of Justice to shut down small vape businesses.

Products have been seized by the FDA at airports, and the agency has ordered its import inspectors to detain shipments of Elf Bar and Esco Bar disposables without first inspecting them.

The FDA has authorized just seven vape devices—all of them manufactured by companies owned by Altria (NJOY), Reynolds (Vuse) or Japan Tobacco (Logic). The agency hasn’t granted marketing permission to any open-system (refillable) products, including bottled e-liquid, or any vape product in a non-tobacco flavor.

Related articles:

Redefining the Next Generation of Electronic Nebulization: Love Miracle unveiled over 20 new products at the World Electronic Cigarette Exhibition

Redefining the Next Generation of Electronic Nebulization: Love Miracle unveiled over 20 new products at the World Electronic Cigarette Exhibition

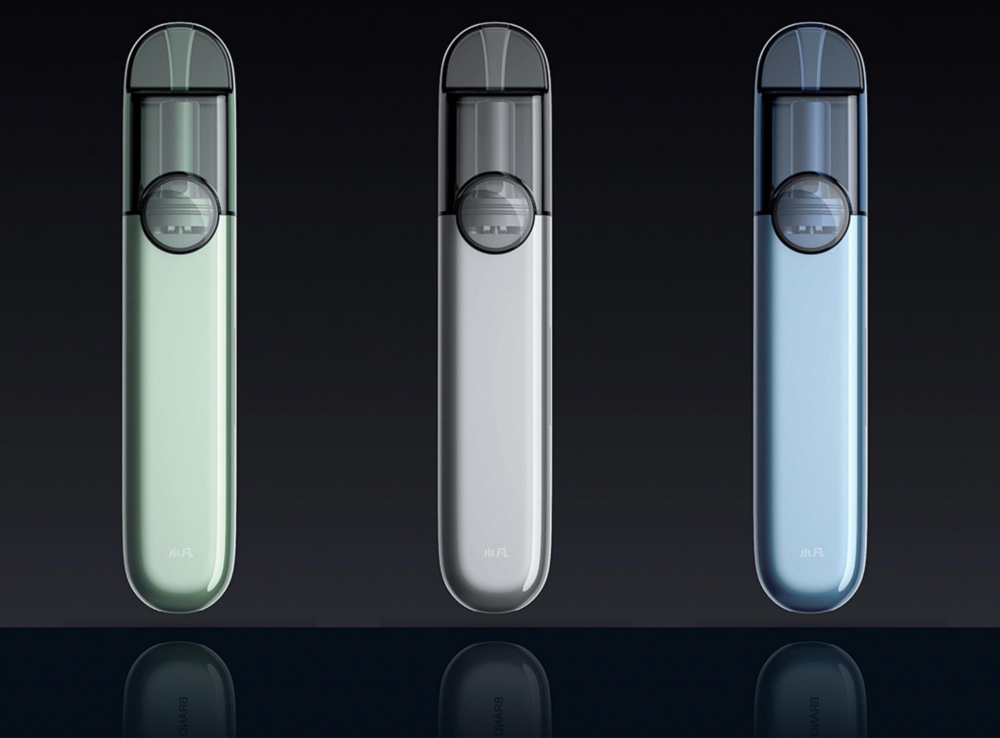

ELF BAR 1200 PREFILLED POD KIT

ELF BAR 1200 PREFILLED POD KIT

Health Canada calls for smoking to be returned from the mouth

Health Canada calls for smoking to be returned from the mouth

MO20000 PRO

MO20000 PRO

Financial Analyst: Disposable Vapes Killing Altria's Cigarette Sales

Financial Analyst: Disposable Vapes Killing Altria's Cigarette Sales

Zahlen und Fakten zum konventionellen Rauchen: Wird in Deutschland wirklich weniger geraucht?

Zahlen und Fakten zum konventionellen Rauchen: Wird in Deutschland wirklich weniger geraucht?